When exporting from Turkey to United Kingdom, You have to write below on the invoice;

The exporter of the products covered by this document (customs authorization

……. (1))Declares that, except where otherwise clearly indicated,

These products are of Turkey (2) preferential origin.

How can you avoid customs duty for Bangladesh origin goods;

1-If you are importing goods from Bangladesh into the EU countries, you need a REX number. On the invoice, write Rex Declaration as follows;

The exporter ……….. REX Registration number: ……….. of the products covered by this documents declares that, except where otherwise clearly indicated, these products are of BANGLADESH preferential origin according to rules of origin of the Generalized System of Preferences of the European Union and that the origin criterion meet is ”W” ……

2-If you are importing the goods from Bangladesh to the United Kingdom, you need a Form A certificate.

In early 2023, the UK’s DCTS(Developing Countries Trading Scheme ) will replace the UK’s current Generalised Scheme of Preferences (GSP).

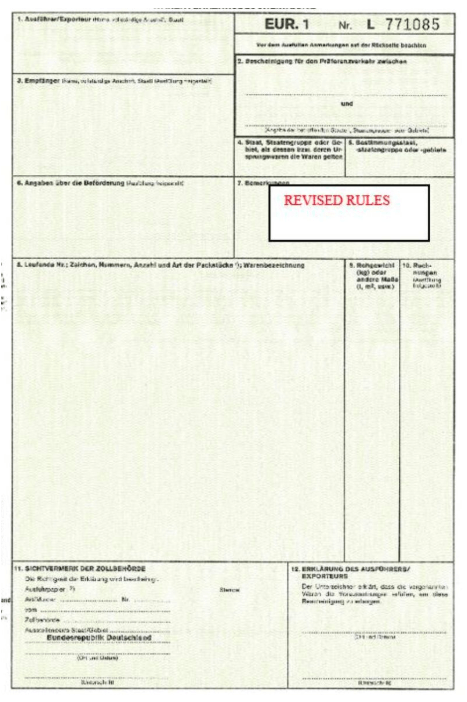

Next Steps for “Revised Rules” of Origin

At a technical meeting in Brussels on February 5, 2020, representatives from PEM Contracting Parties agreed to move forward with the application of revised rules of origin on a transitional basis. Countries involved include Bosnia and Herzegovina, the EU, Türkiye, and others, along with EFTA and CEFTA secretariats.

The revised rules offer an optional alternative to the existing PEM Convention rules, providing economic operators the choice to apply the rules best suited to their needs. Key improvements include:

- Flexible regional cumulation and simpler product-specific rules

- Increased tolerance thresholds for non-originating materials (from 10% to 15%)

- Duty-drawback for most products

- Replacement of the “direct transport” rule with a “non-manipulation” rule

- Potential for electronic origin certificates in the future

The European Commission will propose amendments to bilateral agreements, aiming for adoption before summer 2020. Detailed guidance and seminars will follow to support implementation.

These changes aim to modernize and streamline trade, benefiting businesses and aligning with recent trade agreements.