UK Trade Performance in 2025: Import and Export Trends, Challenges and Opportunities

As 2025 comes to an end, the United Kingdom’s trade environment reflects a year shaped by global economic uncertainty, post-Brexit adjustments, and evolving supply chains. For companies involved in importing to or exporting from the UK, understanding how trade performed in 2025 provides valuable insight into market direction and future opportunities.

UK Exports in 2025: Gradual Recovery and Market Diversification

UK exports in 2025 showed moderate improvement compared with 2024, supported by stabilising global demand and expanding trade relationships beyond Europe. Growth was most visible in machinery, transport equipment, chemicals, and professional services.

Non-EU markets continued to gain importance. Trade with North America, the Middle East, and Asia increased as UK exporters diversified destinations to offset slower EU demand and ongoing regulatory friction.

Despite this recovery, exporters still faced challenges including compliance costs, customs procedures, and currency volatility affecting competitiveness.

UK Imports in 2025: Slower Growth and Changing Supply Chains

Import activity in the UK expanded only modestly during 2025. Higher financing costs earlier in the year and cautious consumer spending reduced demand for retail goods and construction-related imports.

However, the structure of UK imports continued to evolve:

- Reduced reliance on some EU suppliers

- Increased sourcing from Asia, especially China, India, and Southeast Asia

- Strong demand for energy products, electronics, and industrial inputs

These changes reflect the UK’s ongoing supply-chain diversification strategy in response to geopolitical risks and post-Brexit trade realignment.

Trade Policy and Customs Developments in the UK

2025 marked further progress in UK trade facilitation and customs modernisation. Important developments included:

- Continued rollout of digital border systems and the UK Single Trade Window

- Simplified customs processes for importers

- Progress in free trade negotiations with India and CPTPP countries

- Adjustments to border controls on EU goods

These measures aim to reduce administrative burdens and improve trade efficiency for businesses trading with the UK.

Key Challenges for UK Importers and Exporters in 2025

Businesses engaged in UK trade navigated several persistent pressures:

- Freight and logistics costs above pre-pandemic levels

- Exchange-rate fluctuations affecting import pricing

- Regulatory complexity in EU-UK trade

- Global geopolitical disruptions impacting supply chains

Companies that adapted through supplier diversification and stronger customs planning proved more resilient.

UK Trade Outlook for 2026

Although 2025 was not a high-growth year for UK trade, it represented a period of stabilisation and structural transition. Export diversification and digital customs systems are laying the foundation for improved trade efficiency.

Looking ahead to 2026, expectations include:

- Stronger export momentum as global demand improves

- More efficient border procedures

- Continued expansion of non-EU trade

- Opportunities in sustainable and technology-driven imports

For businesses trading with the UK, the key lesson from 2025 is clear: adaptability, diversification, and regulatory readiness are essential for long-term success.

EzyCompost – Recyclable & Compostable Packaging Materials

The Sustainable Alternative for a Circular Economy

For years, traditional packaging has followed the same linear pattern:

“Sell – consume – throw away.”

Today, brands can no longer afford this model.

At TT Tradings, we introduce EzyCompost — an innovative material solution that enables companies to transition from a waste-creating system to a circular, regenerative packaging model.

EzyCompost is a next-generation, biopolymer-coated paper material that is both fully recyclable and fully compostable, without producing persistnt microplastics.

Why EzyCompost?

Recyclable. Compostable. Microplastic-Free.

EzyCompost delivers high performance while meeting the strongest sustainability requirements.

Key benefits include:

- 100% recyclable in standard paper-recycling streams

- Certified home & industrial compostable

- Completely microplastic-free

- Strong KIT-11 grease and liquid barrier

- FDA A–H, Prop 65 and allergen compliant

- Ideal for cups, bowls, food containers, wraps and premium printed packaging

EzyCompost offers the same functionality and barrier performance as traditional PE-coated materials — but without the environmental cost.

From “Use & Dispose” to “Use, Recover & Regenerate”

A sustainable future requires more than reducing plastic use.

It requires redesigning packaging to stay within the resource cycle.

With EzyCompost, the products your customers use do not become waste — they become a resource.

Packaging made with EzyCompost can be:

- Collected and recycled through existing paper streams

- Composted in home or industrial composting systems

- Returned to nature safely, without releasing microplastics

This transforms single-use packaging from a problem into a valuable part of the circular economy.

A Smarter Choice for Forward-Thinking Brands

Brands that adopt EzyCompost gain measurable environmental and strategic advantages:

- Reduced plastic and fossil-based materials

- Lower carbon footprint

- Compliance with new EU & global packaging regulations

- Seamless integration into recycling and composting infrastructures

- Stronger sustainability reputation and customer trust

Less waste. More value. Real circularity.

Learn More About EzyCompost

For samples, technical data sheets or partnership inquiries, please contact us.

TT Tradings — Your trusted partner in next-generation sustainable packaging.

UK Import Trends 2025: New Opportunities Emerging in Mechanical and Automotive Sectors

As the UK moves further into 2025, new import trends are beginning to reshape the country’s trade landscape. Recent data published by HM Revenue & Customs (HMRC) and the Office for National Statistics (ONS) highlights significant growth in several key import categories — creating fresh opportunities for businesses looking to enter or expand within the UK market.

Key Import Trends in 2025

1. Mechanical Appliances Lead Import Growth

According to July 2025 trade statistics, mechanical appliances recorded one of the largest month-on-month increases, rising by over 13%.

This category includes:

- Industrial machinery

- Engines and generators

- Pumps and compressors

- HVAC and energy-efficient systems

This trend reflects the UK’s rising demand for modern, low-carbon, and energy-efficient equipment across manufacturing, construction, and energy sectors.

2. Automotive Imports Strengthen

Imports of motor vehicles and automotive components also increased in mid-2025.

Driving factors include:

- Strong consumer demand

- Expansion of EV (electric vehicle) infrastructure

- Supply shortages in domestic production

This creates strong potential for suppliers of EV parts, batteries, vehicle electronics, and engine components.

3. Chemical & Pharmaceutical Imports Rising

ONS data indicates continued growth in medical and pharmaceutical imports, particularly from non-EU countries.

Demand remains high for:

- Medical devices

- Pharmaceuticals

- Chemical raw materials

Healthcare-related supply chains continue diversifying due to global uncertainty and rising demand.

What This Means for Exporters Targeting the UK

For companies planning to sell products into the UK in 2025, the data reveals clear opportunities:

✅ High Potential Product Categories

- Mechanical machinery and industrial equipment

- Automotive parts & EV components

- Medical devices & pharmaceuticals

- Chemical raw materials

- Smart manufacturing technologies

✅ Why the UK Market Is Attractive

- Increasing diversification of global supply chains

- Government incentives for clean and efficient technologies

- Growing demand for non-EU suppliers post-Brexit

- Ongoing investment in infrastructure and automation

Looking Ahead: 2025–2026 Forecast

Industry analysts expect mechanical and transportation-related imports to continue rising throughout 2025, supported by:

- Improved business confidence

- Strengthening currency stability

- New trade partnerships (including CPTPP and India agreements)

- Digitised customs systems (UK Single Trade Window rollout)

Businesses that position themselves early will gain a competitive advantage in one of Europe’s most dynamic import markets.

How T.T. Trading Supports Your UK Market Entry

T.T. Trading specialises in helping manufacturers and exporters enter the UK market with confidence.

We assist with:

- Import compliance

- Market analysis

- Customs & logistics

- Strategic sourcing

- Trade documentation

If you’re looking to expand into the UK, now is an excellent time to explore new opportunities.

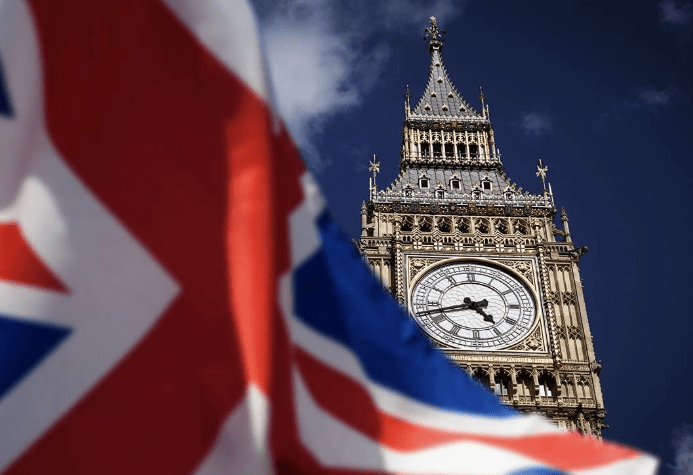

Green Trade Revolution: How Sustainability Is Shaping UK Imports

The UK’s import landscape is undergoing a green transformation in 2025. From low-carbon logistics to eco-certified products, sustainability is redefining trade priorities and supply chain strategies.

As environmental concerns intensify and consumer awareness rises, the United Kingdom is experiencing what many are calling the Green Trade Revolution. In 2025, sustainability has moved from being a corporate buzzword to a core strategy shaping how and what the UK imports.

1. The Rise of Eco-Conscious Imports

The UK’s import profile is evolving rapidly. Businesses are prioritising suppliers who can demonstrate low-carbon production, ethical labour practices, and transparent supply chains.

Key sectors leading this shift include:

- Textiles: Eco-certified fabrics and recycled materials are increasingly demanded by UK retailers.

- Automotive: Imports of electric vehicle components and battery technologies from Europe and Asia continue to rise.

- Food & Agriculture: Organic, fair-trade, and sustainably sourced products from countries like Turkey, Spain, and Kenya are in high demand.

2. Government Policy & Trade Incentives

The UK government is actively supporting green imports through fiscal and regulatory incentives.

- The Carbon Border Adjustment Mechanism (CBAM), currently in consultation, aims to tax high-emission imports while rewarding cleaner alternatives.

- Green customs procedures are being rolled out as part of the UK’s Single Trade Window, promoting paperless declarations and digital compliance.

- New trade deals increasingly include environmental clauses, encouraging partner countries to meet sustainable production standards.

3. Sustainable Logistics and Supply Chains

Transport and logistics — traditionally one of the highest-emission sectors — are undergoing a major transformation:

- Ports like Felixstowe and Liverpool are piloting electric-powered cranes and hydrogen-fueled trucks.

- Carbon tracking systems are being implemented to measure emissions across every stage of the supply chain.

- Businesses are shifting towards nearshoring, sourcing goods from closer markets such as the EU and Turkey to reduce freight distances and emissions.

4. Opportunities for Importers

For importers, the Green Trade Revolution presents both challenges and opportunities:

- Competitive Advantage: Companies adopting sustainability early can secure long-term contracts with major UK retailers and manufacturers.

- Cost Efficiency: Despite initial investment, green logistics often leads to lower energy and transportation costs over time.

- Reputation: Consumers increasingly reward environmentally responsible brands with higher loyalty and willingness to pay.

5. The Outlook for 2025 and Beyond

The UK is on track to make sustainability a standard trade metric, not a niche practice. By 2026, it is expected that over 40% of UK imports will come from suppliers with verified environmental credentials.

As T.T. Trading, we continue to support businesses navigating this shift — helping them connect with sustainable partners, understand green compliance rules, and optimise their import strategies for a cleaner, more resilient future.

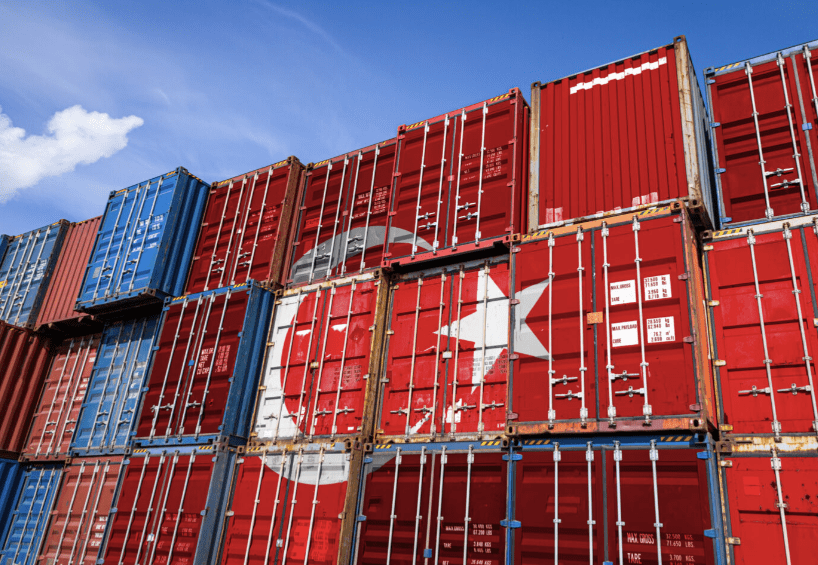

UK Imports from Turkey in 2025: Top 5 Products Driving Trade

The trade relationship between the UK and Turkey has grown significantly over the years, with Turkey remaining a key partner for British importers. In 2025, this partnership continues to thrive, particularly in the automotive, textiles, and electronics sectors.

Below we explore the top five products the UK imports from Turkey, based on data from the four quarters to the end of Q1 2025.

1. Road Vehicles (Excluding Cars)

The largest share of imports comes from road vehicles other than cars, valued at £2.7 billion, accounting for nearly 20% of total UK imports from Turkey. These include commercial vehicles such as buses, trucks, and other capital transport equipment that support logistics and infrastructure.

2. Cars

Turkey is a strong hub for car manufacturing, supplying several global brands. In 2025, the UK imported £1.4 billion worth of cars from Turkey, representing around 10% of total imports.

3. Clothing and Textiles

The UK fashion industry continues to rely heavily on Turkey’s textile sector due to its competitive pricing and proximity. Clothing imports reached £962 million, making up just over 7% of UK imports from Turkey.

4. Miscellaneous Electrical Goods

Turkey also plays an important role in supplying electrical goods, especially intermediate components used in UK manufacturing. This category was worth £778 million, or nearly 6% of UK imports from Turkey.

5. Electrical Machinery

Rounding out the top five is electrical machinery, valued at £748 million. These goods, ranging from household appliances to consumer electronics, accounted for about 5.6% of the UK’s imports from Turkey.

Outlook for UK–Turkey Trade

As the UK continues to diversify its global supply chains, Turkey remains a reliable partner thanks to its strong manufacturing base, customs union ties with the EU, and logistical advantages. The sectors above highlight where Turkey’s competitiveness shines, and they are likely to remain pillars of bilateral trade moving forward.

UK Imports by Country: Key Products in 2025

As of mid-2025, the UK’s import landscape continues to reflect strong ties with major trade partners such as China, Germany, and the United States. Understanding the main categories of goods imported from these countries provides valuable insights into supply chain dynamics and opportunities for businesses.

1. Imports from China

China remains a key supplier of manufactured goods to the UK, though some categories have seen a slowdown.

- 📱 Telecom & sound equipment – £6.9 billion

- 🎧 Consumer electronics – £5.4 billion

- 💻 Office machinery – £5.1 billion

- 🔌 Misc. electrical goods – £4.0 billion

- 🚗 Cars – £3.9 billion

2. Imports from Germany

Germany continues to be a vital partner, especially for high-value industrial goods and vehicles.

- 🚗 Cars – £17.5 billion

- ⚡ Power generators – £3.3 billion

- 🚛 Road vehicles (excl. cars) – £3.3 billion

- 💊 Pharmaceutical products – £2.9 billion

- 🏭 Industrial machinery – £2.5 billion

3. Imports from the United States

While detailed sectoral data is still unfolding, the US supplies the UK with significant volumes of:

- ⚙️ Industrial machinery

- 📡 Telecoms and technology equipment

- 💊 Healthcare and pharmaceuticals

- 📈 Financial and professional services

📊 Summary Table

| Country | Top Imported Products |

|---|---|

| China | Telecoms, electronics, office machinery, electrical goods, cars |

| Germany | Cars, generators, road vehicles, pharma, machinery |

| USA | Machinery, technology, healthcare, services |

Top 5 UK Import Countries (12 Months to May 2025)

| Rank | Country | Value (£ billion) | Share of Total Imports |

|---|---|---|---|

| 1 | Germany | £71.4 | 11.9% |

| 2 | China | £67.9 | 11.3% |

| 3 | United States | £58.0 | 9.7% |

| 4 | Netherlands | £50.3 | 8.4% |

| 5 | France | £36.7 | 6.1% |

Key Insights:

- Germany remains the UK’s top import partner, contributing nearly 12% of total goods imports.

- China follows closely with just over 11%, showing strong consumer and manufacturing input demand.

- The United States ranks third, accounting for nearly 10%, reflecting the broad trade relationship in both goods and services.

- Netherlands and France complete the list, with shares around 8% and 6%, respectively.

UK Economic Outlook and Import Trends: Navigating 2025’s Shifting Landscape

As we progress through the second half of 2025, the UK economy continues to show mixed signals amid global uncertainty, domestic cost pressures, and evolving trade dynamics. For businesses engaged in international trade and import-dependent sectors, understanding the current economic trends is crucial to navigating the months ahead.

Sluggish Growth but Hints of Resilience

The UK economy recorded a modest contraction at the start of the year, with GDP declining by 0.1% in January 2025. This followed a stronger-than-expected 0.4% growth in December 2024, largely driven by seasonal consumer activity. The decline in January was mainly attributed to weaker performance in the manufacturing and construction sectors. However, government spending and consumer resilience are expected to support a modest rebound in the latter part of the year.

Import Activity: Slower Momentum, Rising Costs

Recent trade data suggests that UK imports have been slowing, particularly from the EU. This trend reflects a combination of factors, including:

- Sterling volatility, making imported goods more expensive.

- Extended customs checks and evolving post-Brexit border requirements, especially for small and medium-sized enterprises.

- Global shipping disruptions and elevated freight costs, particularly on Asia-Europe routes.

- Weaker domestic demand, especially in retail and construction sectors.

However, there has been a slight uptick in non-EU imports, particularly from Southeast Asia and North America, as UK firms seek to diversify sourcing partners amid geopolitical risks and supply chain realignment.

Customs Developments and Trade Policy

The UK government continues its push to simplify customs processes through digitisation and regulatory reform. The rollout of the Single Trade Window is expected to streamline import declarations and improve border efficiency by 2026. Meanwhile, free trade agreement negotiations with India and CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership) countries are advancing, with potential tariff reductions on selected import categories.

Inflation and Input Prices

Inflation remains a key concern for importers. Although the Consumer Price Index (CPI) has eased slightly to 2.4% (as of June 2025), input costs for imported goods—especially raw materials and energy—remain elevated. Businesses are advised to monitor foreign exchange movements and secure forward contracts where appropriate to mitigate further cost fluctuations.

Outlook for Import-Driven Businesses

While the short-term environment remains complex, UK importers may find strategic opportunities through:

- Sourcing diversification to reduce overdependence on single markets.

- Leveraging trade finance and customs support schemes.

- Adopting digital tools for supply chain management and customs compliance.

As the global economy continues to adjust and new trade agreements materialise, UK-based importers who remain agile and well-informed will be better positioned to manage risks and capitalise on emerging trends.

UK Trade Dynamics in Focus as Customs and Economic Pressures Intersect

As the UK navigates through a challenging economic landscape in 2025, attention is increasingly turning to its trade and customs environment. Amid persistent inflationary pressures and soft consumer demand, the country’s import-export framework is becoming a key driver of both opportunity and concern for businesses.

Sluggish Trade Amid Economic Headwinds

Recent trade data reveals that both imports and exports have softened in early 2025. A modest uptick in exports to non-EU countries was offset by a decline in trade with the EU, highlighting the continuing impact of Brexit-related regulatory changes and border friction. The Office for National Statistics (ONS) reported a 2.1% drop in overall goods exports in February, with machinery and transport equipment seeing the sharpest falls.

Customs Challenges Persist

Businesses continue to report delays and administrative burdens at customs, especially for EU-bound goods. New digital customs declaration systems introduced in late 2024 have improved efficiency for some, but smaller traders are struggling to adapt. The UK’s HM Revenue & Customs (HMRC) has promised further support, including funding for training and IT infrastructure for SMEs.

Freeports and Trade Zones Gain Attention

Amid these challenges, the UK government is ramping up support for Freeports and special trade zones in areas like Teesside, Liverpool, and East Midlands. These zones, offering tax reliefs and simplified customs processes, are seen as a vital part of the strategy to boost trade volumes and attract foreign investment.

Policy Shifts and Future Trade Deals

Trade policymakers are also in active negotiations with several countries, including India and members of the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership), aiming to diversify the UK’s trade portfolio. A recent agreement in principle with India could significantly ease customs procedures and reduce tariffs on key goods.

Outlook: Balancing Reform with Resilience

As the year progresses, the government’s dual focus on customs reform and trade diversification will be crucial. Businesses are calling for greater clarity, consistency, and cooperation between government departments to ensure that the UK remains competitive in the global marketplace.

While customs-related challenges remain a bottleneck for many traders, targeted reforms and international trade partnerships could pave the way for a stronger second half of 2025.

UK Economy in 2025: A Slow Start with Hopes for Recovery

The UK economy entered 2025 on a sluggish note, experiencing a 0.1% decline in output in January. This contraction was primarily driven by weakness in the production sector, particularly in manufacturing. However, positive growth in December 2024 and expectations of a rebound in the second half of the year, fueled by increased consumer and government spending, indicate potential recovery ahead.

Sluggish Start to 2025

- The UK’s real GDP fell by 0.1% in January 2025, following a 0.4% growth in December 2024.

- The production sector, including manufacturing, experienced a decline, with manufacturing output driving both the monthly and three-month contractions.

- The construction sector also saw a decrease in January, although it showed growth in the three months leading to January.

Factors Behind the Slowdown

- Weak external demand and global economic uncertainty, including concerns over tariffs, contributed to the sluggish start.

- A significant 3% drop in exports weighed on growth in the latter half of 2024.

Signs of a Potential Rebound

- Increased consumer and government spending are expected to drive economic recovery in the second half of 2025.

- The Treasury has been boosting day-to-day government spending, which is likely to be reflected in upcoming GDP figures.

- Strong economic performance at the end of 2024 has provided a stable base for the first quarter of 2025, with an expected GDP growth of 0.3%.

Economic Outlook for 2025 and Beyond

- Despite a weak start, the broader economic outlook is not as bleak as it may seem.

- The UK economy is projected to rebound in the latter half of 2025, with growth stabilizing to more normal levels by 2026.

Key Economic Indicators

- GDP Growth: The Office for Budget Responsibility (OBR) forecasts the UK economy to grow by 1.0% in 2025, a downward revision from previous expectations, but with a projected acceleration to 1.9% in 2026.

- Inflation: Consumer Price Index (CPI) annual inflation rate is expected to remain above 2% for most, if not all, of 2025.

- Business Confidence: Business confidence has dropped to record-low levels, as reported by ACCA’s annual global economic outlook.

While the UK economy has faced a slow start to the year, expectations of increased spending and a stronger second half of 2025 provide hope for recovery and stability moving into 2026.

2025 UK Economic Bulletin

Here are the key points from the 2025 UK economic outlook :

- Economic Growth:

- GDP is expected to grow by 1.9% in 2025, rebounding from 0.1% in 2023 and 1.0% in 2024, aligning with pre-COVID growth trends.

- Consumer Spending:

- A primary driver of growth, consumer spending is projected to rise by 2.5% in 2025, spurred by improved real incomes and falling inflation.

- Inflation and Interest Rates:

- Inflation is forecasted to stabilize at the Bank of England’s 2% target in 2025. Interest rates are anticipated to decline to around 3.5% by mid-2025 as inflationary pressures ease.

- Business Investment:

- After a decline in 2024, business investments are set to recover with an expected growth of 1.8% in 2025, supported by strengthened economic activity.

- Productivity Challenges:

- Despite growth, productivity remains below pre-COVID levels, underlining the need for structural reforms and investments in skills and technology.

- Sustainability and Green Growth:

- Investments in renewable energy and circular economy initiatives are emphasized to drive sustainable growth and reduce environmental impact.

- Labour Market:

- The labour market is resilient, but skill shortages and demographic shifts highlight the need for workforce upskilling and improved mobility.

- Global and Domestic Risks:

- Risks include geopolitical tensions and global trade uncertainties, though cautious optimism prevails as monetary policies shift towards less restrictive stances.

Gemini Cooperation Shifts UK Port Strategy to London Gateway

In a strategic move set to reshape UK port operations, Gemini Cooperation partners Maersk and Hapag-Lloyd have designated London Gateway as their primary UK hub for Asia-North Europe services. This transition, effective from February 2024, will result in Maersk redirecting its traffic away from Felixstowe, marking a significant change in trade routes.

Key Implications:

1. London Gateway Gains Prominence: The shift underscores the growing importance of London Gateway in handling major global shipping routes, bolstering its role in UK-European trade.

2. Felixstowe Adjustments: As the UK’s largest port, Felixstowe will face short-term challenges due to the realignment. However, its position remains strong, thanks to the continued presence of the Ocean Alliance, which maintains two Asia-North Europe service calls.

3. MSC’s Strength at Felixstowe: With Maersk’s departure, MSC solidifies its status as the largest carrier operating at Felixstowe, highlighting its crucial role in the port’s continued operations.

This development reflects a broader realignment in UK shipping infrastructure, with potential ripple effects on trade efficiency and port competition. Felixstowe’s ability to adapt and attract new business will be key to maintaining its leading position in the UK shipping landscape.

For further insights into how these changes will impact UK logistics and trade, stay tuned to our updates.

ECONOMIC OUTLOOK IN UK, TODAY (2024 November 05)

UK’s current economic outlook based on the latest data and forecasts:

Growth Forecasts

- The UK’s GDP growth projections for 2024 have been revised upward, with forecasts now suggesting around 0.9% growth by year-end. This adjustment reflects improved business and consumer confidence and signs of recovery following pandemic-related and inflationary challenges.

Inflation Rates and Impact

- Inflation has decreased to meet the Bank of England’s 2% target, primarily due to falling energy and food prices. However, core inflation—excluding food and energy—remains around 3.5%, driven by persistent wage pressures. The gradual return of inflation to target levels has helped stabilize household finances and increased purchasing power.

Monetary Policy and Interest Rates

- With inflation still high in specific areas like services, the Bank of England is cautious about reducing interest rates significantly. The current rate is at 5.25%, but slight cuts are anticipated by the end of 2024 if inflation continues to fall. These moves aim to balance inflation control with economic stimulation.

Labor Market Dynamics

- The labor market has started to loosen, with unemployment rising to 4.2% and projected to reach 5% by year-end. While labor market tightness previously drove wage growth, this loosening is expected to ease wage pressures, with wage growth likely to slow from around 8% to 3% over the next year

Structural Challenges: Productivity and Investment

- Long-term issues like low productivity and weak business investment remain significant. UK productivity is growing at only 0.3% year-over-year, much slower than in countries like the U.S. Post-Brexit challenges and uncertainty over economic policy continue to dampen investment levels, which will be crucial for future economic growth.

Public Finances and Fiscal Policy

- The October Budget introduced new fiscal measures to stabilize government finances, control public debt, and manage inflation. The government plans additional spending cuts and has adjusted some benefit schemes to manage costs. The Office for Budget Responsibility highlighted the importance of these measures for economic stability, especially as an election approaches.

Global and Geopolitical Risks

- The UK remains exposed to global risks, particularly fluctuations in energy prices driven by geopolitical tensions. If energy prices surge again, inflation could increase, potentially impacting consumer confidence and economic stability.

This structured outlook reflects the UK’s efforts to balance growth and stability amidst inflation control, labor market adjustments, and structural economic challenges.

ECONOMIC OUTLOOK, TODAY (2024 September 16)

- Markets are focusing on Treasury auctions and the economic data agenda today.

- The August budget data and the reissuance of fixed-coupon and CPI-indexed bonds maturing in 2026 will be monitored. The Treasury will complete its monthly borrowing program this week.

- This week, interest rate decisions from the U.S., U.K., Japan, and Turkey are in the spotlight.

- After peaking at 34.55 in the illiquid market, the USD/TRY exchange rate turned downward and ended last week just below 34. This morning, initial quotes were around 33.95.

- Asian markets are starting cautiously this week, anticipating an interest rate cut in the U.S., with markets divided on the size of the expected cut.

- The Bank of Japan and the Bank of England are expected to keep rates unchanged this week, while U.S. retail sales and industrial production data will be watched closely.

- Geopolitical events continue to influence markets, with another assassination attempt on U.S. Republican presidential candidate Donald Trump reported yesterday.

- Trading volumes in Asia are low due to holidays in China, Japan, South Korea, and Indonesia, leading to minimal market movements.

- Industrial production in China rose by 4.5% year-on-year in August, the lowest in five months, while retail sales and new home prices continued to decline.

- The probability of a 50-basis-point rate cut by the Fed rose to 59%, driven by expectations of aggressive monetary easing. This probability was 30% last week.

- Markets are pricing in a total of 114 basis points of rate cuts by the Fed by Christmas and an additional 142 basis points next year.

- U.S. bond prices rose on the increased likelihood of a larger rate cut, with the yield on 2-year Treasury notes falling to the lowest level since September 2022.

- The Bank of England is expected to keep rates at 5% at its monetary policy meeting on Thursday, with a 31% chance of another rate cut being priced in.

- While the Bank of Japan is expected to keep rates steady on Friday, it is believed to be laying the groundwork for a stronger tightening policy in the following month.

- The Euro rose 0.57% against the dollar after the ECB cut rates by a quarter point as expected and ECB President Christine Lagarde lowered expectations for another cut in October.

- The Tokyo stock exchange will be closed until Tuesday, the Chinese stock exchange until Wednesday, and the South Korean stock exchange until Thursday due to holidays.

ECONOMIC OUTLOOK, TODAY (2024 September 10)

- Investor risk appetite increased ahead of U.S. inflation data set for Wednesday.

- Equity indices rebounded from recession fears with broad-based gains, except in the communication sector.

- Apple introduced new products, including the iPhone 16, AirPods, and Apple Watch, but its stock showed little reaction.

- Boeing avoided a potential strike by reaching a temporary labor deal with its largest union, leading to a 3% stock increase.

- U.S. 10-year Treasury yields struggled to find direction, while the dollar and gold prices strengthened.

- Oil prices rose amid concerns that Tropical Storm Francine could disrupt production.

- In China, exports grew more than expected, but weak domestic demand was evident as imports fell short of forecasts.

- Investors are also focusing on the debate between presidential candidates Donald Trump and Kamala Harris, with their opposing views on taxes and government spending affecting different sectors.

- Key reports expected today include the OPEC report and U.S. crude oil inventories.

ECONOMIC OUTLOOK, WEEK (2024 August 12-16)

Global Markets:

United States:

- Inflation Data: The Producer Price Index (PPI) came in below expectations, with a monthly increase of just 0.1% and an annual rise of 2.2%. The Consumer Price Index (CPI) matched expectations, showing an annual increase of 2.9% for headline inflation and 3.2% for core inflation.

- Market Reaction: The absence of an upside surprise in inflation data, coupled with stronger-than-expected retail sales and jobless claims, helped boost risk appetite.

- Bond Yields: The U.S. 10-year Treasury yield decreased by 5 basis points, ending the week at 3.90%.

- Stock Markets: The S&P 500 gained 3.9%, and the Nasdaq saw a significant increase of 5.2%.

- This Week: With a lighter data schedule, the focus will be on Friday, August 23rd, when Fed Chair Jerome Powell delivers his speech at the Jackson Hole symposium. His remarks on the U.S. economy and monetary policy will be closely watched.

Europe:

- Growth Data: Quarterly GDP growth in the Eurozone was reported at 0.3%, in line with expectations.

- Stock Markets: European equities followed the global trend, with gains across the region averaging 3.2%.

- Bond Yields and Currency: The German 10-year bond yield remained unchanged, while the narrowing yield gap between the U.S. and Germany led to a 1% appreciation in the EUR/USD exchange rate.

- This Week: European inflation data will be the key focus.

Asia:

- Japan: Japan’s growth data exceeded expectations, leading to a significant increase in risk appetite. The Nikkei 225 index surged by 8.5% for the week.

- China: Chinese stocks saw more modest gains, with the CSI 300 index rising by 0.5%.

- This Week: Japan’s inflation data will be in focus.

Commodities and Precious Metals:

- Oil: Brent crude traded within a narrow range, closing the week flat, as strong U.S. economic data was offset by concerns over weak demand from China.

- Commodity Index: The Bloomberg Commodity Index showed no change for the week.

- Precious Metals: Gold prices saw a notable increase of 3.2%, driven by safe-haven buying ahead of potential geopolitical risks over the weekend.

- This Week: Geopolitical developments and Powell’s remarks at Jackson Hole will be crucial for commodity and precious metal prices.

Turkiye Markets (Turkey):

- Current Account Balance: Turkey’s current account posted a surplus of $407 million in June, the first surplus in nine months, exceeding expectations.

- Risk Premium: Turkey’s 5-year CDS premium fell by 10 basis points to 270, reflecting a decrease in global volatility.

- Stock Market: The BIST 100 Index saw continued profit-taking, ending the week with a 0.9% decline.

- Turkish Lira: The Turkish Lira continued to appreciate in real terms.

- This Week: The Central Bank of Turkey’s (CBRT) interest rate decision is highly anticipated, with expectations that the policy rate will be held steady at 50%. Markets will also be closely watching the accompanying statement for guidance on future monetary policy.

ECONOMIC OUTLOOK, WEEK (2024 August 5-9)

Global Markets:

United States:

Last week, global markets experienced the highest volatility since the pandemic in 2020. U.S. markets saw increased volatility due to weaker-than-expected jobs data from the previous week and a rate hike by the Bank of Japan.

- ISM Services Data: Came in above expectations.

- Jobless Claims: Showed positive results, helping to reduce volatility.

- Bond Yields: The U.S. 10-year Treasury yield rose by 15 basis points, closing the week at 3.95%.

- Stock Markets: After suffering losses of up to 5% on Monday, positive economic data helped the S&P and Nasdaq indices recover and finish the week flat.

- Inflation Data: U.S. inflation data (PPI on Tuesday, CPI on Wednesday) will be closely watched. A continued downward trend in inflation would support markets, but an upward surprise could reignite volatility.

Europe:

- Volatility: Despite a lack of significant data, European markets saw increased volatility, mirroring global trends.

- Bond Yields: The German 10-year bond yield increased by 10 basis points, reaching 2.25%.

- Stock Markets: While early losses were seen in the week, European markets rebounded towards Friday, finishing flat for the week.

Asia:

- Volatility: Asia experienced significant volatility, with Japan’s Nikkei Index seeing daily swings of over 10%.

- Bank of Japan: The Bank of Japan signaled it would halt further rate hikes until markets stabilize, easing some of the volatility.

- China: Inflation data exceeded expectations, but core demand remained weak.

- This Week: Japan’s growth data will be a key focus.

Commodities and Precious Metals:

- Oil: After starting the week with steep declines, Brent crude recovered with a 3.5% gain, driven by easing recession concerns.

- Bloomberg Commodity Index: Gained nearly 1%.

- Gold: After safe-haven buying in the previous week, gold prices remained flat.

- This Week:U.S. inflation data will likely influence commodity and precious metal prices.

Turkiye Markets (Turkey):

- Inflation: Turkey’s July inflation came in below expectations, rising 3.23% monthly, while the annual inflation rate fell to 61.78%.

- Credit Default Swap (CDS) Premiums: Turkey’s 5-year CDS fell by 10 basis points to 280 as global risk aversion eased.

- Stock Markets: The BIST100 Index declined by 5.4% due to global volatility.

- Turkish Lira: Continued to appreciate in real terms.

- This Week: The current account balance data will be in focus for domestic markets.

ECONOMIC OUTLOOK, WEEK (2024 July 29- August2)

Global Markets:

US Markets:

- Federal Reserve Decision: On Wednesday, the Fed kept the federal funds rate range unchanged at 5.25-5.50%, as expected. They noted the ongoing decline in inflation and signaled readiness for rate cuts. Fed Chair Powell emphasized confidence in the inflation trend and highlighted the growing importance of employment data.

- Employment Data: On Friday, US employment data showed a smaller-than-expected increase in job numbers, and the unemployment rate unexpectedly rose from 4.1% to 4.3%.

- Interest Rates: Long-term interest rates saw significant movements, with the 10-year Treasury yield dropping by 40 basis points to close the week at 3.80%.

- Stock Markets: There were sharp declines in equity markets: the S&P 500 fell by 2%, the Nasdaq by 3.1%, and the Russell 2000 saw a substantial 6.8% drop.

European Markets:

- Inflation Data: Inflation in the Eurozone slightly exceeded expectations, with headline and core inflation rising by 2.6% and 2.9% annually, respectively.

- Interest Rates: Amid a global decline in risk appetite, European interest rates also fell but less sharply due to higher-than-expected inflation. The German 10-year yield dropped by 25 basis points to 2.15%.

- Stock Markets: European equities mirrored global trends, with a 2.5% decline across the board.

Asian Markets:

- Japan: The Bank of Japan raised its policy rate by 15 basis points to 0.25% and significantly slowed its bond purchases, leading to a drop in risk appetite. The Nikkei index fell by nearly 5%, while the Japanese Yen appreciated by almost 5% against the US dollar.

- China: Weaker-than-expected PMI data weighed on market sentiment, with the CSI300 index losing around 1%.

Commodities and Precious Metals:

- Oil: Brent crude fell by 4.3% due to global growth concerns. The Bloomberg Commodity Index declined by 1.3%.

- Precious Metals: Gold and silver prices rose by 2.4% and 2.3%, respectively, driven by falling interest rates and rising geopolitical risks in the Middle East.

Turkiye Markets (Turkey):

- Credit Default Swaps (CDS): The 5-year CDS premium rose by 30 basis points to 290 due to global risk aversion.

- Stock Markets: The BIST100 index fell by 3.8%, in line with global market declines.

- Currency: The Turkish Lira remained stable, continuing its trend of real appreciation despite low risk appetite.

- Inflation Data: July CPI data will be released this week. Expectations are for a 3.45% increase, with preliminary data showing a slightly lower 3.23% rise.

ECONOMIC OUTLOOK, WEEK (2024 July 22-26)

Global Markets:

US Markets:

- Economic Data:The US economy grew by 2.8% in Q2, exceeding expectations. Core PCE increased by 2.6% annually, aligning with expectations, while maintaining a downward monthly trend. Flash PMI showed manufacturing at 49.5, indicating contraction and balancing risk appetite.

- Stock Markets: Rotation theme continued in US equities with the S&P remaining flat, the Nasdaq down 2%, and the Russell 2000 up 3.7%.

- Interest Rates: The 10-year Treasury yield fell by 5 basis points, ending the week at 4.20%.

- Upcoming Events: This week, the focus will be on the Fed’s interest rate decision, expected to hold rates at 5.25-5.50%. Fed Chair Powell’s commentary post-decision is expected to be dovish, potentially boosting risk appetite. Additionally, Friday’s employment data will guide market direction.

European Markets:

- Economic Data: Flash PMI data fell short of expectations, leading to a cautious risk environment.

- Stock Markets: European equities traded sideways overall.

- Interest Rates: Germany’s 10-year yield decreased by 5 basis points, closing at 2.40%, contributing to the stability of the EUR/USD pair.

- Upcoming Events: This week, focus will be on Eurozone growth and inflation data.

Asian Markets:

- Currency and Stock Markets: The Japanese Yen appreciated by 2.5% against the USD amid speculation of a rate hike by the Bank of Japan. This anticipation negatively impacted stock markets, with the Nikkei down 6.1% and the CSI300 down 3.7%. Despite a rate cut by the Chinese central bank, risk appetite remained subdued, with Chinese tech stocks losing nearly 5%.

- Upcoming Events: Key focus will be on China’s PMI data and the Bank of Japan’s rate decision.

Commodities and Precious Metals:

- Oil: Brent crude declined by 2% due to weakening growth expectations in China. The Bloomberg Commodity Index fell by 1.5%.

- Precious Metals: Gold prices remained flat, while silver fell by 5% due to growing global growth concerns.

- Upcoming Events: Fed Chair Powell’s remarks will be crucial for commodity and precious metal pricing.

Turkiye Markets (Turkey):

- Monetary Policy: The Central Bank of Turkey (CBRT) kept the policy rate unchanged at 50%, emphasizing a firm stance on combating inflation. The decision was perceived as hawkish.

- Risk Premium and Currency: The 5-year CDS premium decreased by 5 basis points, closing at 260. The Turkish Lira continued to appreciate in real terms.

- Stock Markets: The BIST100 Index saw a 2.4% decline due to profit-taking at dollar-based levels.

- Upcoming Events: No major domestic data releases are expected this week, but risk appetite is expected to recover in line with global trends.

ECONOMIC OUTLOOK, WEEK (2024 July 15-19)

Global Markets:

US Markets:

- Retail Sales Data: Retail sales remained flat month-over-month, defying expectations of a 0.3% decline. This indicates that consumer demand has not cooled as anticipated.

- Interest Rates: The 10-year Treasury yield rose by 7 basis points, closing the week at 4.24%. Markets continue to expect at least two to three rate cuts from the Fed by year-end.

- Stock Markets: The S&P and Nasdaq indices saw profit-taking, declining by 2% and 3.7%, respectively. The Russell 2000 Index, which includes small-cap firms, gained 1.8%.

- Key Data for the week: Core PCE, flash PMI, and growth figures will be closely monitored. Election-related news will also be in focus.

European Markets:

- ECB Decision: The ECB kept its policy rate steady at 4.50%, as expected. ECB President Lagarde emphasized data-dependent decision-making. Markets anticipate two rate cuts by year-end and five cuts by the end of 2025.

- Inflation Data: Both headline and core inflation matched expectations, increasing annually by 2.5% and 2.9%, respectively. Stable European rates contrasted with a slight rise in US rates, leading to a 0.3% weekly decline in the EUR/USD pair.

- Stock Markets: European stocks fell by 2.6%, influenced by profit-taking in the US.

Asian Markets:

- Stock Markets: Mixed performance was seen across Asian bourses, reflecting global risk aversion. China’s CSI300 Index rose by 1.8%, while the technology sector declined by 4%. Japan’s Nikkei 225 Index dropped by 2.7%.

- Upcoming Data: China’s central bank will announce the lowest lending rate. Japan’s inflation data will also be closely monitored.

Commodities and Precious Metals:

- Oil: Brent crude fell by 2.7% due to demand concerns following weak growth data from China. The Bloomberg Commodity Index declined by 3.2%.

- Precious Metals: Despite an initial rise, gold prices remained flat for the week, closing above $2,400 per ounce, influenced by rising US rates.

Turkiye Markets (Turkey):

Economic Data:

- Moody’s Credit Rating: Moody’s upgraded Turkey’s credit rating by two notches from B3 to B1, maintaining a positive outlook. The upgrade was attributed to improved communication and a firm return to orthodox monetary policy.

- Stock Markets: The BIST100 Index gained 0.8%.

- Risk Premium: Turkey’s CDS premium remained stable.

- Exchange Rate: The Turkish Lira continued to appreciate in real terms.

- Upcoming Data: This week, the CBRT is expected to keep the policy rate steady at 50%.

ECONOMIC OUTLOOK, WEEK (2024 July 8-12)

Global Markets:

US Markets:

- Inflation Data: The headline CPI fell by 0.1% month-over-month, well below the expected 0.1% increase. Core CPI also rose by only 0.1% month-over-month, below expectations. Annually, headline and core CPI increased by 3% and 3.3%, respectively.

- Interest Rates: With lower inflation data, interest rates declined, with the 10-year Treasury yield falling by 8 basis points to close at 4.18%. The market expects a 25 basis point rate cut from the Fed in September with 100% certainty and a total of 75 basis points cut by year-end with a 60% probability.

- Stock Markets: The S&P and Nasdaq indices remained flat, while the Russell 2000 (small-cap index) and biotechnology sectors gained 6.5%. ETFs investing in the construction sector saw weekly gains of over 10%.

European Markets:

- Stock Markets: European stocks benefited from the rotation theme triggered by the US inflation data, gaining 1.6%.

- Interest Rates: The German 10-year bond yield remained flat, closing the week at 2.50%.

- Exchange Rate: The EUR/USD pair rose by 0.6%.

Asian Markets:

- China Data: Chinese inflation data came in below expectations, with the CSI300 Index gaining 1%. Monday morning’s Chinese growth data also fell short of expectations. A sideways trend in risk assets is expected to continue in China throughout the week.

Commodities and Precious Metals:

- Oil: Brent oil declined by 1.1% due to the weakening of the hurricane in the US. The Bloomberg Commodity Index fell by 1.5%.

- Precious Metals: Gold gained nearly 1% in response to falling interest rates, closing the week above $2,400 per ounce. FED members’ speeches this week will be significant for commodity and precious metal prices.

Turkiye Markets (Turkey):

Economic Data:

- Current Account: The May current account deficit was $1.24 billion, below the expected $1.5 billion.

- Risk Premium: Turkey’s 5-year CDS fell by 5 basis points to 255, driven by the decline in global interest rates.

- Stock Markets: The BIST100 Index in Istanbul gained 2%.

- Exchange Rate: The Turkish Lira continued to appreciate in real terms.

ECONOMIC OUTLOOK, WEEK (2024 July 1-5)

Global Markets:

U.S. Markets:

- Employment Data: Nonfarm payrolls increased by 206,000, slightly above expectations, but previous two months saw a downward revision of 111,000. The unemployment rate rose to 4.1%, aligning with the Fed’s year-end estimate, suggesting a soft landing.

- PMI Data: Leading PMI indicators came in slightly below expectations, indicating economic cooling.

- Interest Rates: Treasury yields fell, with the 10-year yield closing the week down 10 basis points at 4.25%.

- Equity Markets: The S&P 500 and Nasdaq indices rose by 2% and 3.5%, respectively.

- Upcoming Data: Focus will be on inflation data, with the headline CPI expected to drop to 3.1% annually. Market participants are not anticipating an inflation surprise, keeping employment data as the key influencer of risk sentiment.

European Markets:

- Inflation Data: Core CPI increased by 2.9% annually, slightly above the 2.8% forecast.

- Interest Rates: German 10-year bond yields rose by 4 basis points to 2.54%.

- Currency Markets: The EUR/USD pair gained 1.2% for the week as the interest rate differential between the U.S. and Europe narrowed.

- Equity Markets: European stocks gained 2.5%, mirroring global trends.

- Upcoming Data: No significant data releases; focus remains on the second round of the French elections and their market impact.

Asian Markets:

- China: Diverged from global trends with the CSI 300 index down 0.9% due to increased news on bond sales.

- Japan: Risk appetite increased in line with global markets.

- Upcoming Data: China’s inflation data will be monitored, with potential central bank interventions in the forex market under scrutiny.

Commodities and Precious Metals:

- Oil: Prices rose due to a hurricane and decreasing U.S. inventories, with Brent crude gaining 0.6%. The expectation of higher demand during the summer travel season and weather-related supply disruptions supports an upward trend.

- Bloomberg Commodity Index: Increased by 1.5%.

- Precious Metals: Gold and silver surged by 2.8% and 7.2%, respectively, driven by declining U.S. interest rates.

- Upcoming Data: U.S. inflation data will be pivotal for commodity and precious metal markets.

Turkiye Markets (Turkey):

- Inflation Data: Monthly CPI increased by 1.64%, below expectations, with annual inflation falling to 71.60%.

- Credit Default Swaps (CDS): The 5-year CDS premium fell by 20 basis points to 260, reflecting improved market sentiment.

- Interest Rates: The 10-year government bond yield dropped by 100 basis points to 27.35%.

- Equity Markets: The BIST 100 index rose by nearly 2%, benefiting from global risk appetite.

- Currency Markets: The Turkish Lira continued to appreciate in real terms.

- Upcoming Data: No significant domestic data releases; risk sentiment is expected to remain strong.

Golden Week (October 1st – 7th/24)

Freight rates on the Asia-North Europe route have surpassed $10,000 and are expected to remain high until China’s Golden Week holiday in October, possibly continuing until Q2 next year.

An early peak season is predicted to extend to Golden Week, with importers ensuring stock availability for Christmas amid longer transit times and port congestion. If the peak season lasts this long, the market is unlikely to decline significantly until Q2 next year.

A further 50% rate increase is possible before Golden Week, with predictions that rates could exceed $15,000. Vessel space is very limited, with some importers booking four weeks in advance.

Sea freight spot prices continue to spike (July 2024)

Global sea freight continues to face high demand, prolonged transit times, and port congestion, driving up spot freight rates even as a record number of new container ships are delivered. Recent increases in port congestion in Asia and the Mediterranean have removed an additional 500,000 TEU from circulation.

Despite adding over 1.6 million TEU to the global container fleet this year, the market has fully absorbed this capacity due to diversions around the Cape of Good Hope. The global container fleet now exceeds 30 million TEU, having grown by 50% in seven years, with another 3 million TEU expected this year from 478 new containerships.

Nevertheless, there is still a capacity shortage, leading to surging freight and charter rates as the market approaches the summer peak season. Recently, 2.5 million TEU were queued at ports worldwide, accounting for nearly 7% of the global fleet, with delays caused by ship bunching from Asia reducing global schedule reliability to just over 50%.

Spot rate indexes from Asia have soared, with FAK rates up nearly 500% from 2023, and analysts anticipate continued rises until demand eases. Congestion has affected major Asian ports, though it has slightly eased due to increased transshipment through India, which now faces its own congestion. Singapore’s berthing delays have reduced, but longer dwell times persist.

Cargo routing away from the Suez Canal has led to longer waits at western Mediterranean ports for transshipment eastward. Northern European ports are performing relatively well, though Rotterdam, Hamburg, and Aarhus have seen increased yard densities, prompting quicker container pickups.

Despite optimistic global trade growth forecasts from the OECD, WTO, and IMF for 2024, there will still be insufficient freight to fill all container ships when the Suez Canal route reopens.

ECONOMIC OUTLOOK, WEEK (2024 JUNE 24-28)

Global Markets:

U.S. Markets:

- Core PCE Data: The core PCE inflation measure, the Federal Reserve’s preferred gauge, increased by 0.1% monthly and 2.6% annually, indicating a cooling in inflation.

- Michigan Inflation Expectations: The survey showed a decline in 5-year inflation expectations from 3.1% to 3%, but varied significantly across income groups, indicating that expectations are not fully anchored.

- GDP Revision: The Q1 GDP growth was revised up from 1.3% to 1.4%, driven by government spending and investments, which was viewed positively by markets.

- Interest Rates: The 10-year Treasury yield remained mostly flat but ended the week up 10 basis points at 4.35%.

- Equity Markets: Both the S&P 500 and Nasdaq indices were relatively flat.

- Upcoming Data: This week will see a busy data schedule, including leading PMI indicators and employment data on Friday.

European Markets:

- No Major Data Last Week: Markets remained focused on the upcoming French elections.

- Interest Rates: German 10-year bond yields increased by 10 basis points, closing at 2.5%.

- Equity Markets: European stocks mirrored global trends and stayed flat.

- Currency Markets: The EUR/USD pair experienced low volatility.

- Upcoming Data: European inflation data will be released this week.

Asian Markets:

- China: The market was stable with no major data releases.

- Japan: The Yen hit a 30-year low against the Dollar. Tokyo’s inflation exceeded expectations, potentially leading to a rate hike by the Bank of Japan. Japanese equity markets were flat.

- Upcoming Data: China’s PMI data will be crucial this week. The Bank of Japan’s potential interventions could influence market sentiment.

Commodities and Precious Metals:

- Oil: Oil prices moved within a narrow range, influenced by the political developments in the U.S., notably Trump’s stance in a debate, which boosted energy sector ETFs by 2.6%.

- Bloomberg Commodity Index: No significant changes were observed.

- Precious Metals: Despite rising interest rates, precious metals remained steady.

- Upcoming Data: U.S. employment data will be a key focus for commodity and precious metal markets.

Turkiye Markets (Turkey):

- GFI’s Decision: Turkey was removed from the FATF’s grey list on June 28, 2024.

- Central Bank Policy: The Central Bank of Turkey (TCMB) kept the policy rate at 50%, signaling potential tightening if inflation worsens. New measures to reduce TL liquidity were introduced.

- Credit Default Swaps (CDS): The 5-year CDS premium remained stable at 275.

- Equity Markets: The BIST 100 index declined by 1.1% due to profit-taking.

- Currency Markets: The Turkish Lira continued to appreciate in real terms.

- Upcoming Data: Inflation data will be critical, with expectations of a 2.2% monthly increase in CPI. A lower-than-expected inflation figure could bolster risk appetite.

ECONOMIC OUTLOOK, WEEK (JUNE 17-21)

The key points from last week’s (June 17-21) global markets;

U.S. Markets:

- PMI Data: Preliminary PMI data for both services and manufacturing exceeded expectations and remained in growth territory.

- Interest Rates: Slight upward movement in interest rates; the U.S. 10-year Treasury yield rose by 5 basis points, ending the week at 4.25%.

- Equity Markets: The S&P 500 Index remained flat. The Nasdaq Index, more sensitive to interest rates, experienced a nearly 1% decline.

- Upcoming Focus: This week, the core PCE, the FED’s preferred inflation measure, will be published, with a limited monthly increase of 0.1% expected. Michigan inflation data will also be monitored; strong risk appetite is expected to continue if there are no upward inflation surprises.

European Markets:

- PMI Data: Eurozone PMI data came in slightly below expectations, leading to a downward movement in regional interest rates. The German 10-year bond yield decreased to 2.38%. The EUR/USD pair lost 0.5% in value over the last two days as U.S. interest rates rose.

- Equity Markets: Equity markets remained flat, mirroring global trends.

- Upcoming Focus: No significant data releases are expected this week, but speeches by European Central Bank members will be closely watched.

Asian Markets:

- China: Despite low inflation data from the previous week, the People’s Bank of China did not change the lowest credit interest rate, causing a drop in market risk appetite. The CSI 300 Index declined by 1.5%.

- Upcoming Focus: No major data releases are expected this week, and a flat trend is anticipated.

Commodity and Precious Metals:

- Market Activity: No significant movements were observed in the last two business days.

- Upcoming Focus: The core PCE data from the U.S. will be crucial for commodity and precious metal prices.

Turkey Markets (Turkiye) :

- Equity Markets: No significant data was released in the last two business days. The BIST 100 Index increased by 2.9%, reflecting the previous week’s rise in global risk appetite.

- Credit Default Swaps (CDS): Despite a slight upward movement in U.S. interest rates, Turkey’s 5-year CDS premium decreased by 5 basis points, ending the week at 275.

- Upcoming Focus: The Central Bank of Turkey (TCMB) is expected to keep the policy rate unchanged at 50%. The markets will be focused on the messaging regarding inflation control in the TCMB’s statement.

Upcoming Events (Week of June 24):

- U.S.: Core PCE data will be released. Michigan inflation data will be closely monitored.

- Europe: Speeches by European Central Bank members.

- Asia: No major data releases expected.

- Turkey: The Central Bank of Turkey’s policy rate decision.

ECONOMIC OUTLOOK, WEEK (JUNE /24 3-7)

The key points from last week’s (June 3-7) global markets;

U.S. Markets:

- Employment Data:

- Non-farm payrolls for May increased by 272,000, surpassing expectations.

- Wage data showed a monthly increase of 0.4% and an annual increase of 4.1%, both above expectations.

- Interest Rates:

- Early in the week, interest rates moved downward.

- Following the strong employment data, the U.S. 10-year Treasury yield closed the week flat at 4.45%.

- Other Data:

- Strong PMI data continued to support risk appetite.

- The S&P and Nasdaq indexes gained 1.3% and 2.4%, respectively.

- Upcoming Focus:

- This week, inflation data and the Federal Reserve’s (FED) monetary policy decision are crucial.

- Markets do not expect a rate cut from the FED at this meeting, but updates on economic projections, inflation, and growth forecasts will provide significant signals on future monetary policy paths.

European Markets:

- European Central Bank (ECB):

- The ECB cut the policy rate by 25 basis points to 4.25%, in line with expectations.

- However, raising inflation expectations was seen as a hawkish*(Note) message post-rate cut.

- Germany:

- The 10-year bond yield remained steady.

- The EUR/USD pair showed limited weekly changes.

- Other Data:

- PMI data for the Eurozone came in slightly below expectations.

- Equity markets experienced a low-volatility week.

- Upcoming Focus:

- German inflation data will be closely watched this week.

Asian Markets:

- China:

- Limited data flow last week.

- The CSI300 Index closed the week flat, mirroring global markets.

- Upcoming Focus:

- Chinese inflation data will be crucial to understand the recovery in demand.

Commodity Markets:

- Oil:

- Faced selling pressure due to unexpected increases in U.S. stockpiles, with Brent crude down 2.4% for the week.

- Bloomberg Commodity Index:

- Decreased by 1.2%.

- Precious Metals:

- Gold prices dropped by 1.5% due to easing geopolitical tensions and strong U.S. employment data.

- Upcoming Focus:

- The FED’s monetary policy signals will significantly impact commodity and precious metal prices.

Turkey Markets (Turkiye):

- Inflation:

- Consumer Price Index (CPI) rose by 3.37% month-on-month, with an annual increase of 75.45%.

- The highest monthly increase was in clothing and footwear, followed by housing due to the end of natural gas bill support.

- Core inflation saw a moderate decrease, with annual core inflation reported below headline inflation for the first time in 14 months.

- Credit Default Swaps (CDS):

- The 5-year CDS premium remained stable at around 260.

- Equity Markets:

- Profit-taking continued, with the BIST100 Index losing 2.5%.

- The Turkish Lira appreciated in real terms.

- Upcoming Focus:

- This week, the current account balance data will be in focus.

Upcoming Events (Week of June 10):

- Wednesday:

- U.S. inflation and FED rate decision.

- German inflation data in Europe.

- Chinese inflation data in Asia.

- Monday:

- Turkish current account balance data will be the market’s focus.

(Note *: The term “hawkish” is used to describe a tight monetary policy.)

ECONOMIC OUTLOOK, WEEK (MAY/24 27-31)

The key points from last week’s (May 27-31) global markets;

1.U.S. Markets:

- U.S. GDP growth for the first quarter was revised down to 1.3% from the initial estimate of 1.6%, leading to a decrease in risk appetite.

- The core Personal Consumption Expenditures (PCE) data, the Fed’s preferred inflation gauge, came in below expectations, showing a monthly increase of 0.2% and an annual increase of 2.8%, balancing risk appetite.

- Despite high volatility in interest rates, the U.S. 10-year Treasury yield remained flat at around 4.50% for the week.

- Equity markets experienced high volatility in line with the bond market, with the S&P index closing the week flat and the Nasdaq index witnessing around 1% profit-taking. This week, U.S. non-farm payroll data and leading PMI indicators will be closely monitored.

2.European Markets:

- Inflation data for the Eurozone exceeded expectations, with headline and core inflation increasing by 2.6% and 2.9% respectively on an annual basis.

- European Central Bank (ECB) Chief Economist Philip Lane’s statement suggesting that although inflation is expected to spike this year, it would be appropriate to make monetary policy less restrictive, despite rising German interest rates, kept the EUR/USD pair stable.

- Equity markets in Europe had a balanced week in line with global markets, with overall gains of around 0.2%. This week, ECB’s interest rate decision and PMI data will be monitored.

3.Asian Markets:

- Disappointing PMI data from China, below expectations, led to low risk appetite. The CSI300 Index in China experienced a weekly decline of 0.7%, with technology sector losses reaching 2%. This week, private sector PMI data from China will be crucial.

4.Commodity Markets:

- Oil prices remained steady ahead of the OPEC meeting on Sunday. The direction of oil prices this week will be determined by supply-oriented decisions to be announced over the weekend.

- Precious metals witnessed sideways movement in line with global markets. Increased peace talks in the Middle East over the weekend may lead to continued stability in precious metal prices for some time.

- This week, U.S. employment data will be significant for commodity and precious metal pricing.

5.Turkiye Markets (Turkey):

- Despite ongoing monetary tightening, the Turkish economy grew by 5.7% in the first quarter of 2024, driven by accelerated household consumption ahead of local elections. Consumption contributed the most to growth, at 5.5%.

- For the first time in a long while, there was a positive impact from net exports. However, the trade deficit in April increased by 12.9% compared to the same month last year, reaching $9.863 billion, the highest monthly trade deficit in nine months.

- Turkish 5-year CDS remained at around 260 levels. While profit-taking was observed in the stock market on a weekly basis, the BIST100 Index lost 2.6%. Revaluation of the Turkish Lira continued, and May inflation increased by 3.37% monthly, with an annual inflation rate of 75.45% for May.

ECONOMIC OUTLOOK, WEEK (MAY/24 20-24)

The key points from last week’s (May 20-24) global markets;

1.U.S. Markets:

- The Federal Reserve (FED) meeting minutes were closely followed, revealing officials’ concerns about inflation and readiness to tighten monetary policy if inflation risks increase.

- Market expectations for two interest rate cuts in 2024 decreased to one, with the anticipated rate cut expected to come at the December meeting.

- Long-term interest rates moved upwards, with the U.S. 10-year Treasury yield closing the week at around 4.48%.

- The PMI data, serving as leading indicators, exceeded expectations in both the services and manufacturing sectors, balancing risk appetite.

- The University of Michigan’s inflation expectations, reported below expectations at 3.3% for both the short and long term, further supported risk appetite.

- Despite hawkish comments from the FED, strong data continued to prevail, with the S&P index closing the week flat and the Nasdaq index gaining 1.4% weekly, partly due to Nvidia’s strong earnings. This week, market participants will focus on U.S. growth data and the core PCE inflation data, the FED’s preferred inflation gauge.

2.European Markets:

- PMI data for the Eurozone remained in line with expectations, continuing the recovery trend.

- Germany’s 10-year yield reached 2.58% in line with the global rise in interest rates, while the EUR/USD pair remained flat.

- European stock markets experienced low volatility throughout the week. This week, Eurozone inflation data will be in focus.

3.Asian Markets:

- The People’s Bank of China did not change its lowest lending rate. However, hawkish messages from the FED midweek and increasing tensions between the U.S. and China led to selling pressure in the CSI300 Index, resulting in a weekly decline of 2%.

- This week, PMI data from China will be the most important data affecting risk appetite in the region.

4.Commodity Markets:

- Crude oil, after weeks of high volatility, experienced a weekly decline of 2.2% in Brent crude prices due to reduced geopolitical tensions and strong inventory data from the U.S.

- Precious metals experienced a weekly decline of 3.3% in gold prices due to rising global interest rates and reduced geopolitical tensions. This week, the U.S. core PCE data will be an important factor in commodity and precious metal pricing.

5.Turkiye Markets (Turkey):

- The Central Bank of the Republic of Turkey (TCMB) kept its policy rate steady at 50%, in line with expectations. Additionally, liquidity measures were taken to withdraw excess liquidity from the market, resulting in the overnight interest rate starting to trade from the ceiling level of 53% on Friday, May 24.

- Despite the increase in global interest rates, Turkey’s 5-year CDS remained stable at 266. The Turkish lira continued its real appreciation trend observed in the foreign exchange market. The stock market remained steady in line with global markets’ sideways movement.

ECONOMIC OUTLOOK, WEEK (MAY/24 6-10)

The key points from last week’s (May 6-10) global markets;

1-U.S. Markets:

- The University of Michigan’s consumer confidence index was below expectations, reaching its lowest level in the past six months.

- Short-term inflation expectations increased from 3.2% to 3.5%, while long-term inflation expectations rose from 3% to 3.1%.

- Despite a previous cooling in interest rates due to a slowdown in employment data, inflation expectations were revised upwards, leading to a sideways trend.

- The U.S. 10-year Treasury yield continued to trade at 4.50%. Although risk appetite started strong at the beginning of the week, rising inflation expectations on Friday dampened it.

2-European Markets:

- Service and composite PMI data for the Eurozone exceeded expectations, maintaining growth momentum.

- Germany’s 10-year yield remained steady at 2.50%, and the EUR/USD pair experienced low volatility.

- The rebound in Eurozone leading indicators and signals from the European Central Bank for a rate cut in June had a positive impact on European stock markets, resulting in gains of nearly 3.2%.

3-Asian Markets:

- The CSI300 Index in China gained 1.7% weekly, reflecting strong demand following higher-than-expected CPI data.

- With low volatility in Asia, strong risk appetite is expected to continue this week.

4-Commodity Markets:

- After weeks of high volatility, oil prices remained stable last week, with Brent experiencing a flat weekly trend.

- The Bloomberg Commodity Index saw a 1.4% gain, led by precious metals, while gold appreciated by 2.6% weekly due to increased geopolitical tensions.

5-Turkey Markets :

- The Central Bank of the Republic of Turkey (CBRT) released its inflation report, revising the year-end CPI (Consumer Price Index-TUFE) inflation forecast from 36% to 38%, while maintaining the upper band at 42%.

- The CBRT President reiterated the commitment to tight monetary policy to fight inflation.

- As a result of the report, Turkey’s 5-year CDS premium returned to pre-pandemic levels, closing the week at 280 for the first time since 2020.

- The Turkish lira continued to attract foreign interest in terms of real returns.

- The stock market experienced low volatility throughout the week.

ECONOMIC OUTLOOK, WEEK (April/24- 29-May 3)

The key points from last week’s (April 29-May 3) global markets:

1-Global Markets:

- Last week (April 29-May 3), the Federal Reserve (FED) interest rate decision and U.S. employment data were monitored.

- The FED kept its policy rate at 5.25%-5.50% and announced a reduction in its balance sheet reduction pace from $60 billion to $25 billion starting in June.

- Statements by FED Chairman Powell removed the possibility of a future interest rate hike, positively affecting risk appetite.

- U.S. non-farm payrolls data for April showed a lower-than-expected increase, and wages saw a monthly increase below expectations.

2-U.S. Markets:

- Expectations for two interest rate cuts from the FED by the end of the year increased.

- The U.S. 10-year Treasury yield declined to 4.50%.

- The S&P and Nasdaq Indexes gained 0.5% and 1.0%, respectively.

3-European Markets:

- European core CPI data exceeded expectations.

- Germany’s 10-year yield remained at 2.50%.

- The EUR/USD pair appreciated by 0.7% weekly.

- European stock markets gained 0.6%.

4-Asian Markets:

- High China PMI data increased risk appetite.

- There was no movement in the Mainland Index CSI300, but Chinese technology ETFs traded in the U.S. saw gains of over 7%.

5-Commodity Markets:

- Oil experienced a weekly decline of 7.4% in Brent due to reduced tensions in the Middle East.

- Precious metals, led by a decrease in geopolitical tensions, saw a 1.5% decline in the price of gold.

6-Turkiye (Turkey) Markets:

- Monthly CPI (Consumer Price Index-TUFE) data showed a lower-than-expected increase.

- Turkey’s 5-year CDS risk premium declined to 292.

- S&P upgraded Turkey’s credit rating from B to B+ with a positive outlook.

THE SUMMARY OF THE LAST WEEK 01/05/2024

Here are the key points from last week’s global markets in bullet point format:

- Last week (April 22-26), the focus was on US GDP growth and core PCE data.

- US GDP growth in the first quarter came in below expectations at 1.6%, compared to an expected growth rate of 2.5%.

- Consumption, particularly driven by services, stood out in the subcomponents of growth, while increased imports negatively impacted growth the most.

- Core PCE data showed monthly and yearly increases of 0.3% and 2.8%, respectively, in line with expectations.

- Strong consumer activity within the subcomponents of growth and inflation data in line with expectations positively influenced risk appetite.

- Interest rates remained flat due to a busy borrowing schedule, with the US 10-year Treasury yield trading around 4.65%.

- Increased risk appetite in the stock markets led to gains of 2.7% and 4.0% in the S&P and Nasdaq Indexes, respectively.

- The focus this week will be on the Fed’s decision to keep the policy rate unchanged, along with any messages it delivers for the upcoming period.

- In the European region, services remained in the growth zone in the flash PMI data, while manufacturing continued to contract.

- European stock markets observed a 2.7% increase overall, in line with global risk appetite.

- German bond yields remained flat, and the EUR/USD pair experienced low volatility.

- This week, attention will be on the Eurozone’s flash inflation data for April.

- In Asia, the People’s Bank of China kept its 1 and 5-year loan prime rates unchanged at 3.45% and 3.95%, respectively.

- Lower-than-expected inflation data in Japan and higher-than-expected growth data in South Korea supported risk appetite in Asia.

- The CSI300 Index in China appreciated by 1.2%, with returns in the technology sector exceeding 10%.

- This week, attention will be on China’s flash PMI data.

- In commodities, oil prices balanced out last week with decreased geopolitical tensions, but were supported by significant downward surprises in US inventory data.

- Brent crude gained nearly 2.5% weekly following the release of the data.

- The Bloomberg Commodity Index saw sideways movement due to declines in precious metals.